California is one of the most populated states in the country--meaning every year, there seems to be more and more cars on the road. Unfortunately, this leads to an increase in car accidents, and an increase in the likelihood that you can be affected. At Bridgeway Legal Funding, we hope you and your family never have to experience a car wreck. But, should an accident happen, it’s important that you’re aware of all your options for a full financial recovery.

Have you been injured in a car accident in California? If you have been, you likely filed a personal injury claim to recoup the damages you suffered from the crash. Read on to learn how to get that money faster with the help of Bridgeway Legal Funding, and click here to get started on an application.

How soon will I get my money after a car accident in California?

If you’ve filed a personal injury claim, you could wait months or even years to see that money. If you’ve been injured, and can’t go to work, we understand that you likely can’t afford to wait that long. If you’re stuck in this situation, pre-settlement funding can advance you a portion of your settlement today. All funding is non-recourse, meaning you only have to pay it back if you win our case

How does Bridgeway Legal Funding help me get car accident settlement money faster?

Have you heard of pre-settlement funding? Those who cannot wait months, or even years, to get their car accident settlement money, turn to our team to get the money they need right away.

A pre-settlement advance awards you, the plaintiff, a portion of your settlement money now, to help you pay for accident-related expenses faster. As you already know, a car accident in California can create thousands of dollars of damage. If your car has been totaled, or you suffered extensive medical injuries, it’s no secret that you need money fast to recover. Pre-settlement funding (sometimes called a lawsuit loan) gives you a portion of your settlement early, but it also buys your lawyer more time to fight for the full value of your personal injury case.

Additionally, many drivers find out the hard way that they are under insured. After a bad car accident, you may be left with a little to no insurance money to help cover the cost of damages. Every state sets limits on the minimum amount of insurance coverage that is required to operate a vehicle, but sometimes this minimum coverage simply isn’t enough. If you’ve been in an accident, and fear that your insurance payout will not be sufficient financial assistance, a lawsuit loan is a good way to get an advance on your settlement.

California minimum insurance requirements are:

- Bodily injury liability coverage: $15,000 per person and $30,000 per accident minimum

- Personal injury protection: $3,000 per accident

- Uninsured motorist bodily injury coverage: Minimum $15,000 per person and $30,000 per accident

- Under-insured motorist property damage coverage: Minimum $3,500 per accident

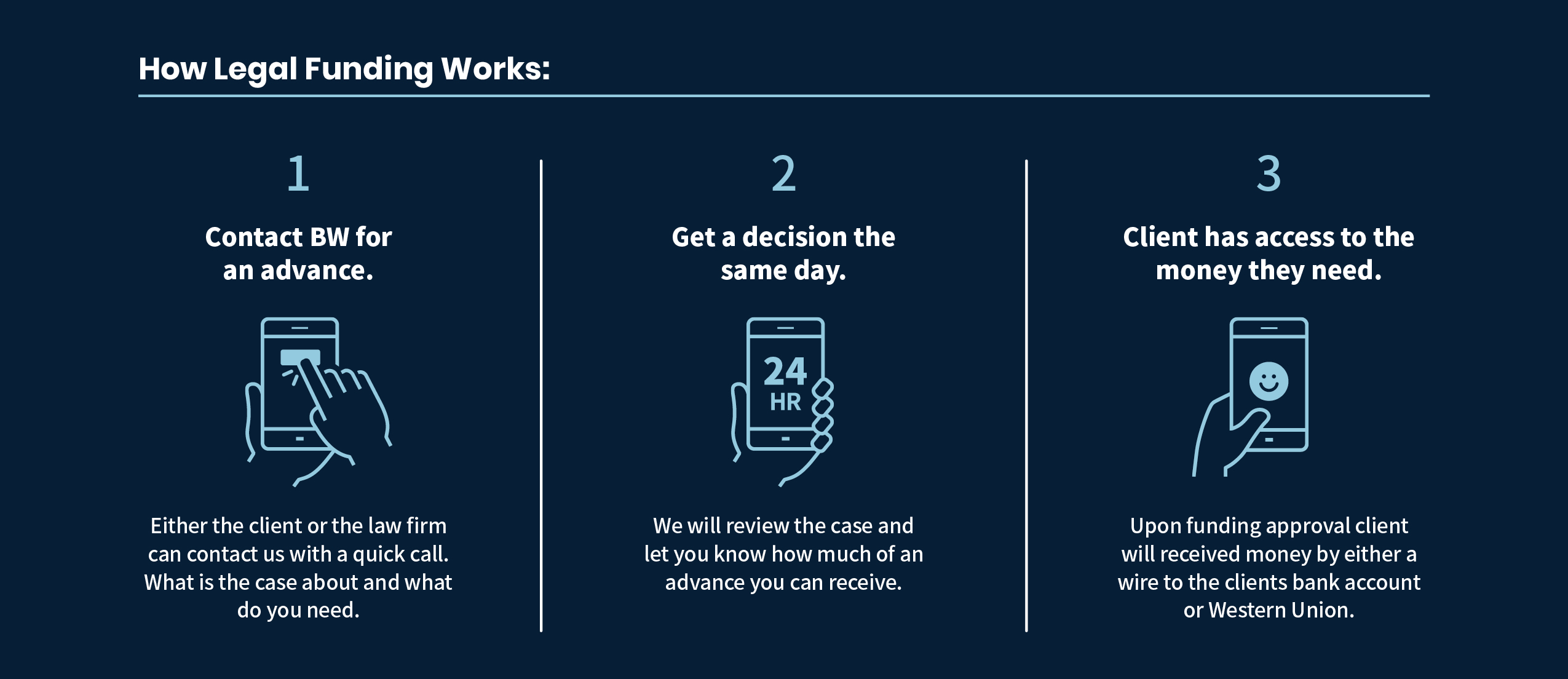

How does pre-settlement funding work?

We have a three step process for helping clients like you secure their pre-settlement in advance.

First, we review your personal injury case. Sometimes, we contact your lawyer to get detailed information about the legal proceedings.

Next, we calculate your case's estimated value based upon a number of factors.These factors include the extent of the damage, injuries that occurred from the crash, and the associated liability.

Lastly, in under 48 hours, we can approve your pre-settle in advance. Due to our unique business model, we’re able to offer 10 to 20% of what your car accident claim is estimated to be worth.

How do I qualify for a pre-settlement advance in California?

A “lawsuit loan” is technically not a loan at all-- so there is no credit check, background check, or any other requirements necessary to file for pre-settlement funding. It is only required that you have an active car accident claim for which you’re waiting on a settlement and an attorney representing you in the case.

In order to secure a pre-settlement advance, make sure you and your attorney file your lawsuit within the legally allowed time frame for personal injury lawsuit in California. The statute of limitations in California is two years from the day of your accident.

To learn more, visit Bridgeway's Guide to Pre-Settlement Funding.

Do I have to pay back my pre-settlement advance?

Since a pre-settlement advance is not a loan, you do not have to pay back the funds if you lose your case. Since pre-settlement funding is a non-resource advance, you keep the money if you never receive a settlement.

Fill out this form to contact Bridgeway Legal Funding and apply for pre-settlement funding.