Are you struggling with your finances because of a car or motor vehicle accident? If you are, you’re not alone and Bridgeway Legal Funding may be just the solution you need.

According to the 2019 South Carolina Collision Statistics, one traffic collision occurs every 3.7 minutes-- and one person was injured every nine minutes. Personal injury law exists to protect accident victims from paying out of pocket for injuries that someone else caused. But when accident victims file personal injury claims, sometimes the system takes an incredibly long time to process these claims. This leaves South Carolina car accident victims, who are injured and forced to stay home to heal, without money they need to get by.

The solution to this problem is a cash advance or “Lawsuit Loan” on your accident claim.

What expenses can a car accident cash advance cover?

A car accident settlement cash advance can cover expenses such as:

- Medical expenses, such as hospital bills, the cost of physical therapy or rehabilitative care, doctor co-pays, and more.

- Rent or mortgage payments, or any other pressing bill that is falling past due while you wait for your settlement

- Ordinary living expenses, such food, gas, and every day necessities.

- Car repairs or replacement

How much is my case worth?

The value of your case is contingent upon a few factors. The amount of insurance coverage available for your claim is one factor that determines the maximum amount of money you can get in your non-recourse cash advance.

South Carolina sets a standard for the minimum amount of car insurance coverage you can purchase. According to the South Carolina Department of Insurance, the law states the following:

“South Carolina requires you to carry a minimum of $25,000 per person for bodily injury liability insurance (insurance that protects you against the claims of others who are injured in an accident) and $50,000 for all persons injured in one accident. Claims for bodily injury may include medical expenses, lost wages, and pain and suffering.”

In addition to bodily injury liability insurance, every driver with South Carolina auto insurance is required to purchase other minimums:

- Property damage: $25,000 per accident

- Uninsured motorist bodily injury: $25,000 per person and $50,000 per accident

- Uninsured motorist property damage: $25,000 per accident with a $200 deductible

- Underinsured motorist bodily injury*: $25,000 per person and $50,000 per accident

- Underinsured motorist property damage*: $25,000 per accident

The numbers above are in reference to standard passenger vehicles only. Most states have significantly higher minimum insurance limits for commercial vehicles and trucks— it’s not uncommon for commercial vehicles to have $1,000,000 or more of insurance coverage.

What other factors determine how much funding can I get for my car accident case?

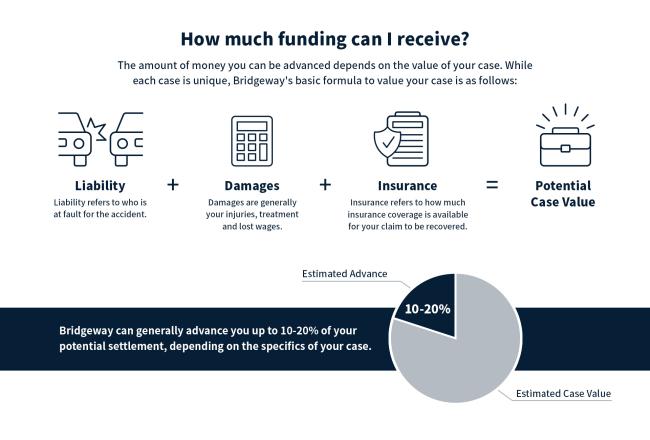

While every South Carolina car accident case is different, there are basic guidelines our team can use to estimate the value of your non-recourse cash advance.

As mentioned above, the amount of insurance coverage available is one factor that will determine the value of your advance. But the total value of damages is a factor, too. Your injuries, the cost of your medical treatment, and the sum of your lost wages all factor into the dollar amount of damages accrued from your car accident case.

In addition to damages, the liability is a factor. If you are not being held liable, or at fault, for the accident occurring, you will likely receive a cash advance bigger than if you had caused the accident. You typically need to be less than 50% at fault in order to file a personal injury claim in many states.

Once our team has determined the value of your case, we can advance you up to 20% of your potential car accident settlement.

How is a non-recourse cash advance different from a loan?

A non-recourse cash advance is sometimes called a lawsuit loan, but it’s really not a loan at all. With a traditional loan, there are application fees, background checks, credit checks, and other associated costs—plus, you have to pay the loan back with interest.

With a non-recourse cash advance, there are no up-front fees, background or credit checks involved in our process. Plus, if you lose your case, you won’t be required to pay back a dime. For this reason, securing a non-recourse cash advance to stay afloat while you wait for your settlement is entirely risk free.

How do I apply for a non-recourse cash advance?

We make the application process easy. Simply contact our team by phone, via our website or by email. We’ll chat briefly about your case and reach out to your lawyer to get pertinent information about your claim. Once you’ve been approved, we prepare a contract, and then wire the funds directly into your account or send a check overnight.

For more information on how to qualify, read on about the application process here.

Why Bridgeway Legal Funding?

There’s a difference working with us over our competitors. Thanks to our vast network of resources in the legal field, Bridgeway Legal Funding is able to secure non-recourse cash advances for our clients much faster. Most funding can be completed within just a day.

Additionally, we’re an active member of the American Legal Finance Association (ALFA) which is a trade organization overseeing the legal funding industry that establishes industry guidelines and best practices in accordance with all laws and regulations. Under these guidelines, we are required to use funding agreements without any hidden fees or costs--so transparency is important to us.