Florida Car Accidents: How To Get Your Settlement Faster

According to Florida Highway Safety And Motor Vehicles, 252,562 injuries occurred last year alone just from car accidents. This means that 252,562 people were left injured and waiting for the financial compensation they deserve and in need of emergency cash to get them through a tough time.

Thankfully Bridgeway Legal Funding exists to help people struggling with money after a motor vehicle accident. When you cannot afford to wait, Bridgeway can get you the cash you need today. There were more than 400,000 crashes in the state of Florida last year, meaning hundreds of thousands of personal injury settlements were processed; each victim waiting weeks, months, or even years to access the settlement money they need to move forward with their lives after the crash.

How can I get my car accident settlement money faster?

While you can’t exactly get your car accident settlement faster, you can get a pre-settlement advance on your future settlement which will give you cash now while you wait for your case to finish. Pre-settlement funding is a cash advance against your pending car accident claim or lawsuit that you only need to re-pay if you win your case. Sometimes, pre-settlement funding is referred to as a “lawsuit loan,” but this type of funding isn’t a loan at all.

What is a non-recourse cash advance?

Commonly referred to as Pre-settlement funding, “lawsuit loans”, legal funding, you name it; all are many names for a non-recourse cash advance, but what’s more important is that you understand how simple it is to receive one. There are no out-of-pocket costs, no credit or background checks and the money can be yours within 24 hours.

This type of funding isn't technically a loan at all, because if you don’t win your Florida car injury claim, you will not be responsible for paying back the money you borrowed. To learn more about pre-settlement advances, visit our Guide to Funding page.

Why would I need a pre-settlement loan after a car accident in Florida?

Those who have suffered car accidents in Florida likely have to recover from injuries, miss work to attend doctor’s appointments, or maybe even lost their car to the accident. There are so many different types of damages that an accident can cause, plus, no one is ever expecting to get into an accident, so paying for these damages is typically an unexpected burden. This is where a lawsuit loan comes in handy.

If you’ve totaled your car, need cash for medical bills, or simply don’t want to wait any longer for your lawsuit settlement, you can contact our team at Bridgeway Legal Funding and seek a cash advance. The process is quick and easy, requiring only a phone call and verification from your law office to confirm the facts of your case.

How much is my case worth? -It’s all about how much insurance coverage.

The amount of insurance coverage there is for your injury claim, sets the maximum settlement you can attempt to win. The state establishes the amount required for each driver to have: minimum auto insurance coverage requirements. Per Florida Highway Safety And Motor Vehicles, anyone who registers and insures a vehicle in Florida must:

- be insured with personal injury protection (PIP) and personal damage liability (PDL) insurance at the time of vehicle registration.

- have a minimum of $10,000 in personal injury protection and a minimum of $10,000 in personal damage liability.

- have continuous coverage even if the vehicle is not being driven or is inoperable. maintain Florida insurance coverage continuously throughout the registration period regardless of the vehicle’s location.

Personal injury protection and personal damage liability will help you pay for damages, but in cases where your insurance company delays or denies your claim, it will be helpful to get money up front with a non-recourse cash advance from Bridgeway Legal Funding.

How long does it take to get a pre settlement cash advance?

If you or a loved one have been involved in a car accident in Florida, our team can get cash into our client’s hands within 24 to 48 hours. Give us a call or apply on our website and our team will contact you immediately to learn more about your case and how much money you’d like to borrow. As soon as we can confirm the details with your lawyer, we can try to approve your funding request.

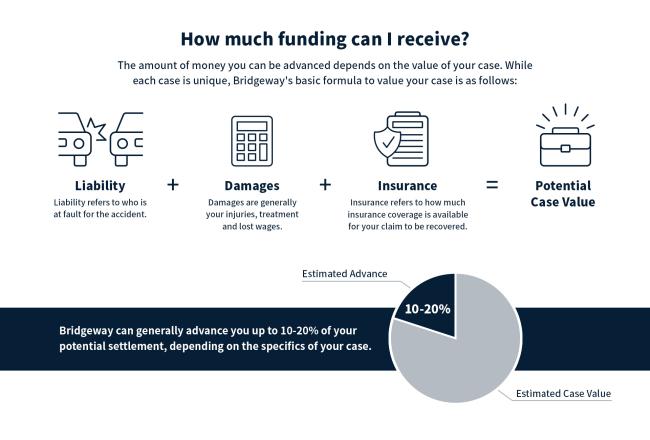

How much of a cash advance can I receive?

The amount of your pre-settlement advance all depends on the potential value of your case. Based upon what we calculate for your case value, we then advance you up to 20% of the estimated future value of your case.

Call us at 800-531-4066 or fill out this form online to get started on the pre-settlement application process right away.